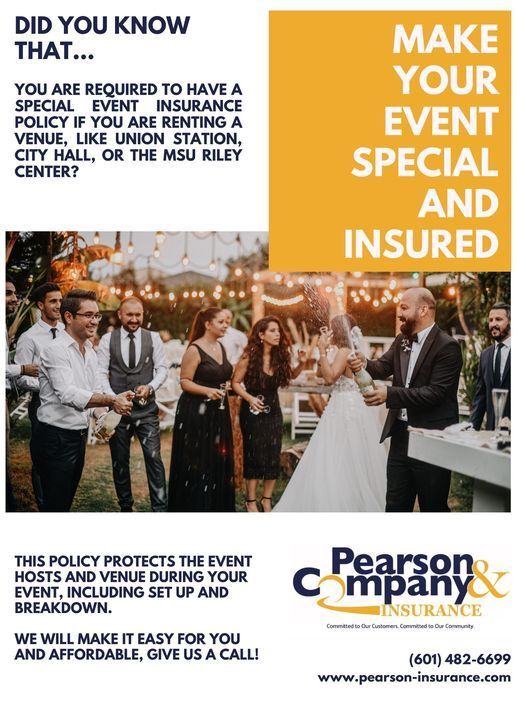

Blog Post

Gap Insurance and What it Covers

When you bring home a new vehicle from the dealership, you may be financing it. Have you ever wondered, "What happens if I get into an accident and face a total loss on the vehicle?" Did you know that you’d be responsible for paying the remainder of your lease or loan even though the car is totaled?!

Even if you have collision coverage (which is what will cover the cost to replace your totaled car) this coverage alone is only going to pay out the actual cash value of your vehicle. Which is often less than what you still owe on your car. Loan gap insurance helps pay this difference, in the event of a total loss, between what you still owe on your totaled vehicle and what the insurance company determines is the vehicle’s actual cash value — so you won’t be left to cover that potential hefty bill all on your own.

Here's an example of how gap insurance works:

You buy a car for $20,500, make a $500 down payment and take out a $20,000 loan with monthly payments of $300.

Four months later, you get into an accident and your car is totaled. Your insurance company says the actual cash value of your vehicle, or the fair market value, is $16,000. They’ll pay this much (minus the deductible) through your collision coverage on your insurance policy.

However, because of the structure of your loan payment, you still have $19,700 to pay on the loan, leaving a gap of $3,700. Without gap insurance, you’d be responsible to pay that entire difference. However, with gap insurance, you’re only responsible for the deductible.

Simply put, gap insurance protects you from having to pay the difference out of your own pocket (for a vehicle you no longer can drive!), while also having to pay for another vehicle, too. Do you carry gap insurance? Call our office today for more information!

Share

Tweet

Share

Mail

January 30, 2024

Embarking on the exciting journey of living independently is a hallmark of Gen Z's coming-of-age experience. As you settle into your new rental space, it's crucial to think about safeguarding your belongings and securing peace of mind. In this blog post, we'll delve into why renters insurance is a must for all renters and introduce you to Pearson & Company Insurance, your trusted partner in Meridian, MS, for comprehensive coverage. Don't leave your newfound freedom vulnerable—protect it with Pearson & Company Insurance. The Gen Z Approach to Renters Insurance: Gen Z is known for its practicality and resourcefulness, and when it comes to protecting your assets, renters insurance is the way to go. It's not just about covering the cost of your belongings; it's an investment in your lifestyle and the memories you're creating in your rented space. Affordable Coverage Tailored to You: Pearson & Company Insurance understands the financial challenges young adults face. That's why they offer affordable renters insurance policies that can be customized to suit your needs. At the cost of a few streaming subscriptions, you can ensure that your belongings are protected from unforeseen events. Local Trust, Global Reach: Based in Meridian, MS, Pearson & Company Insurance brings a local touch to insurance services. This personal connection ensures that you're not just a policyholder; you're a valued member of the community. With a global reach and extensive industry expertise, Pearson & Company Insurance provides the perfect blend of hometown warmth and professional excellence. Easy, Digital Solutions for a Digital Generation: Lifestyles today are all about efficiency and technology. Pearson & Company Insurance stays ahead of the curve by offering user-friendly digital platforms and mobile apps. Managing your policy, filing claims, and obtaining quotes are just a few taps away. It's insurance that keeps up with your fast-paced lifestyle. Tailored Policies for Every Lifestyle: Pearson & Company Insurance understands that every individual is unique. Whether you're a minimalist with a capsule wardrobe or a tech enthusiast with the latest gadgets, their policies can be tailored to fit your specific lifestyle. Choose the coverage that aligns with your needs and priorities. Call for a Quote Today: Ready to take the next step in securing your space? Call Pearson & Company Insurance at 601-482-6699 for a personalized renters insurance quote. Their friendly team is ready to guide you through the process, ensuring you get the coverage you need without breaking the bank. Conclusion: As you embrace the freedom and excitement of living independently, don't overlook the importance of renters insurance. Pearson & Company Insurance in Meridian, MS, is your dedicated partner in securing your space and protecting your belongings. Give them a call today at 601-482-6699 to explore affordable and customized renters insurance options. When it comes to safeguarding your future, Pearson & Company Insurance has you covered.

January 29, 2024

The body content of your post goes here. To edit this text, click on it and delete this default text and start typing your own or paste your own from a different source.

June 13, 2023

Thanks to an unusual convergence of market trends, ushered in by the pandemic and followed by other disruptive events, you may see a bigger change to the cost of your home and auto insurance than usual when it comes time to renew your policies this year. Insurance rates are based on what an insurer thinks it will cost to make you whole in the event of a loss – whether it’s roof damage during a windstorm or a vehicle totaled during a traffic accident. As you’ve likely noticed, pretty much everything costs more than it did even a few years ago. What’s driving higher home insurance costs If you’ve shopped at Home Depot or Lowe’s lately, you’ve certainly seen that the price tags on building materials have gotten pretty expensive. Last year, the cost of building materials rose 4.7%, reflecting a particularly strong uptick in prices on things like asphalt shingles (16.2%), concrete blocks (18.5%) and drywall (20.4%). To make matters worse, the home-building industry is facing a shortfall of more than 300,000 skilled laborers, which is driving up construction-related labor costs. Combined with the high cost of construction materials and historically low housing inventory, this has been making home claims much more expensive for insurance companies. What’s driving higher auto insurance costs Ongoing supply chain issues are driving a shortage of car parts and equipment, which were 22.3% more expensive at the end of 2022 than they were two years earlier. The overall cost of maintaining and repairing vehicles increased 18.4 % over the same timeframe – exacerbated by a growing shortage of car repair technicians. The same issues depleted the supply of new and used cars during the COVID-19 pandemic, and inventories have not yet recovered. As a result, the average price of new cars has risen 20% since 2020, while used car prices have skyrocketed 37%. Rising medical costs are another key factor. While the number of injuries and fatalities from car accidents has somewhat declined from its peak in 2021, the rising cost of medical care continues to drive higher claims costs. Between 2020 and 2022, the overall cost of medical care in the U.S. increased 6.8%. Focus on value as you explore ways to save Keep in mind that savings come in many forms. The value of the coverage you choose today may save you more in the long run than the lowest possible premium. Contact us to review your current coverage We’ll help you explore opportunities for discounts that could offset higher rates when it comes time to renew. Give us a call at 601-482-6699. Sources: National Association of Realtors, Federal Reserve Bank of St. Louis, Home Builders Institute, CoreLogic, Consumer Price Index, TechForce Foundation

April 11, 2023

The bThe Basics of Insurance Insurance is a contract between an insurance company and a policyholder. The insurance company agrees to pay for any losses that the policyholder incurs, up to the limits of the policy. The policyholder agrees to pay a monthly premium to the insurance company. There are many different types of insurance, but the most common types are home insurance, car insurance, and life insurance. Home insurance protects you financially if your home is damaged or destroyed by fire, theft, or other covered events. Car insurance protects you financially if you are in an accident and cause damage to another person's property or injure another person. Life insurance provides a financial benefit to your loved ones if you die. If you are considering getting insurance, it is important to shop around and compare different policies from different companies. You should also make sure that you understand the terms of the policy and what is covered. Here are some of the benefits of having insurance: • Financial protection: Insurance can help you financially if you are injured or if your property is damaged. • Peace of mind: Insurance can give you peace of mind knowing that you are covered in the event of an unexpected event. • Discounts: Many insurance companies offer discounts for things like having a clean driving record or for bundling your insurance policies. Here are some of the drawbacks of having insurance: • Premiums: Insurance premiums can be expensive, especially if you are young and have a clean driving record. • Deductibles: You will usually have to pay a deductible before your insurance company will start to pay for your losses. • Exclusions: Some insurance policies have exclusions, which are things that are not covered by the policy. Overall, insurance can be a valuable asset for protecting yourself financially. If you are considering getting insurance, it is important to shop around and compare different policies from different companies. You should also make sure that you understand the terms of the policy and what is covered.

March 28, 2023

Auto insurance deductibles refer to an amount of money that a policyholder is required to pay out of pocket before their insurance provider covers the rest of the expenses in a claim. In general, the higher the deductible amount, the lower the insurance premiums. However, there are several factors to consider when choosing a deductible for your auto insurance policy. Here are some of the different aspects of auto insurance deductibles and how they affect your coverage and premiums: Impact on premiums: As mentioned earlier, the higher the deductible, the lower the insurance premiums. This is because a higher deductible reduces the insurer's risk exposure and therefore lowers the cost of the policy. However, it's essential to choose a deductible amount that you can comfortably afford to pay out of pocket in case of an accident. Factors to consider when choosing a deductible: There are several factors to consider when selecting a deductible for your auto insurance policy, including your driving habits, the age and condition of your vehicle, and your financial situation. For instance, if you drive frequently or in high-risk areas, you may want to consider a lower deductible to avoid the risk of paying a large sum out of pocket in case of an accident. Impact on coverage limits: It's essential to note that deductibles can affect your coverage limits – the maximum amount your insurance provider will pay out in a claim. For instance, if you have a $500 deductible and a maximum coverage limit of $5,000, you'll only receive up to $4,500 in coverage after paying out your deductible. Deductibles for comprehensive and collision coverage: Deductibles for comprehensive and collision coverage typically range from $100 to $1,000. Comprehensive coverage involves damages to your vehicle due to non-collision incidents such as theft, vandalism, or natural disasters, while collision coverage covers damages caused by collisions with other vehicles or objects. In conclusion, auto insurance deductibles play a crucial role in determining both your insurance premiums and coverage limits. It's essential to choose a deductible amount that strikes a balance between affordability and maximum coverage.

February 23, 2023

If you have rental coverage on your auto insurance policy, you are eligible for a rental car while your car is in the shop being repaired from a covered claim. Rental coverage does not extend if your car is in the shop for repairs not related to a covered claim. Your policy offers rental coverage at a set amount (see your specific policy) for the length of time your car is in the shop with a 30-day maximum. In 2020, the average length of time a customer needed a rental car was 11 days. Today, due to supply chain issues for parts and labor shortages, many body shops are backed up and we're seeing customers max out their 30 days of coverage for their rental car. Our advice, if your car is drivable then do not get your rental car until your body shop has your replacement parts on hand. Once they have your parts on hand, you can drop off your car and pick up a rental car. We don't want our customers having to pay out of pocket for rental expenses so please keep this 30-day limit in mind before you pick up your rental car. Another thing to consider is that the cost of a rental car has increased. If your policy only covers $25 a day, that will not pay the full amount of a rental car any longer. We recommend our customers carry at least $50/day for rental coverage. If you need your rental car to be a pickup truck or a larger SUV, you should carry $100/day. Unsure of your coverage? Email Hallie@Pearson-Insurance.com or Mandy@Pearson-Insurance.com to check your limits.

December 5, 2022

That wonderful Season of Christmas is upon us once again! Doesn't it seem like we just put away the dishes from Thanksgiving? Maybe you're already busy with the preparations...pulling out old family recipes, getting the decorations from the attic, or making that all-important list and checking it twice, so I won't keep you. I just wanted to be among the first to wish you and your family the happiest of Holiday Greetings! I've included two of my family's favorite recipes for your enjoyment. One is irresistibly delicious; the other brings the delightful scents of the season into your home. I hope they'll become your favorites, too! Sincerely, Hallie Swindoll Agent, Pearson & Company Insurance Simple Christmas Potpourri ½ lemon, halved ½ orange, halved 3 cinnamon sticks 3 bay leaves ¼ cup whole cloves 1 qt water Combine all ingredients in saucepan and bring to a boil. Reduce heat and simmer as long as desired. Be sure to check often, adding water as needed. Mixture may be stored in refrigerator several days and reused. Your home will smell great! Christmas Snack Mix 1 jar dry roasted peanuts 2 bags red and green candy coated chocolate candies 2 bags red and green candy coated chocolate covered peanuts 1 bag chocolate covered peanuts 1 jar wheat germ nuts snack Toss all ingredients together and serve or store. This festive mix also makes the perfect gift when layered in decorative containers.

December 1, 2022

What Most Homeowner's Insurance Doesn't Cover Your homeowner's insurance protects you from what are known as perils-the things that might cause damage or loss. A good homeowner's policy is set up to provide coverage for the most likely perils that affect homeowners, such as fire, theft, and vandalism. However, there are some perils that are specifically excluded from the average homeowner's policy, and depending on where you live, these exclusions could be serious. Earthquake Coverage Most homeowner's policies do not provide coverage for damage caused by an earthquake. If you live in an area where earthquakes are common and a serious earthquake is a real risk. Check with your agent to see if you need a separate earthquake policy, or if it can be endorsed (added) to your current home policy. Flood And Water Damage Water damage is a tricky area when it comes to homeowner's insurance. Some types are covered, while others are not. The most commonly excluded type of water damage is from a flood. This usually means a natural flood, from rain or rising water. For anyone who lives near a river or other body of water where flooding is a possibility, flood insurance is a good idea. Water damage that is caused by negligence is also usually excluded. If you knew your pipes were leaking and did nothing to repair them, the resulting water damage will likely be excluded and not covered. On the other hand, if a pipe suddenly bursts with no forewarning, your homeowner's insurance should kick in and take care of the damage. It's best to verify these grey areas with your insurance company or agent. Mold Exclusions Many insurance companies do not provide coverage for mold, because it is considered to be the result of negligence. This is another grey area where some types of mold may be covered and others may not. If there is coverage, it is often limited to a few thousand dollars. Again, this is a good one to discuss with your insurance company. Maintenance Issues Homeowner's insurance is there to get you back to normal after a loss or damage. It doesn't provide you with free maintenance on your home. Any damage to your home caused by your failure to properly maintain it will not be covered by homeowner's. Thus, roof repair for wind damage is covered, but a roof that has simply gotten old will not be. If that were the case, homeowner's insurance would be very expensive indeed, with everyone getting repairs done to their home every time something wore out. It's important to know what your policy covers and doesn't cover, so that you are not stuck paying big bills for a catastrophic event. Ask your agent or read your policy, and obtain extra coverage when you can.

November 15, 2022

If you're not in a high-risk area, you probably don't spend a lot of time worrying about water damage to your home or property. But the fact is, approximately one quarter of all flood loss occurs in areas considered at a low to moderate risk for flooding. No matter how safe you think you are, houses in every type of location suffer flood damage. And recent changes in weather patterns have triggered numerous highly publicized cases of rivers and lakes overflowing and leaving supposedly “safe” zones deep underwater. In fact, did you know that floods are the most costly natural disaster in the U.S. every year? Flood losses total more than a billion dollars annually. Thousands of families have not only lost their home but suffered utter financial ruin due to flooding. Many mistakenly believed their homeowners policy would protect them, only to find out the hard way that the typical homeowners policy doesn't cover flood damage at all. Pearson & Company Insurance specializes in providing homeowners and renters with high quality, affordable flood insurance. We have many carriers to quote with, making sure you’re getting the best rates. Don't let a flood drown your finances. Give us a call today at 601-482-6699, and let's get you covered!

Contact Information

Phone:

Email:

Address:

2210 13th Street Meridian,

MS 39301

Business Hours

- Mon - Fri

- -

- Sat - Sun

- Closed

Quick Form

Contact Us

Thank you for contacting us.

We will get back to you as soon as possible.

Oops, there was an error sending your message.

Please try again later.

Please try again later.

Contact Information

Phone:

Email:

Address:

2210 13th Street Meridian,

MS 39301

Business Hours

- Mon - Fri

- -

- Sat - Sun

- Closed

Contact Us

Contact Us

Thank you for contacting us.

We will get back to you as soon as possible.

Oops, there was an error sending your message.

Please try again later.

Browse Our Website

Contact Information

Phone:

Fax:

(601) 482-1526

Email:

Address:

2210 13th Street Meridian,

MS 39301

Business Hours

- Mon - Fri

- -

- Sat - Sun

- Closed

Sign up for our email!

Content, including images, displayed on this website is protected by copyright laws. Downloading, republication, retransmission or reproduction of content on this website is strictly prohibited. Terms of Use

| Privacy Policy