If we asked you which generation had the best retirement outlook, what would you say? Baby Boomers? Gen Xers?

Surprise! It’s Millennials.

If you’re a Millennial, you’ve probably heard about your generation in less-than-flattering terms, but we’re here to tell you that your generation has the best chance of having a secure retirement.

Though you still have the saving hurdles of older generations, like paying down debt and rising cost of living, you have a distinct advantage as a Millennial: time. And a lot of you are already taking advantage of it.

An impressive 58% of Millennials are currently saving for retirement, compared to 55% of Baby Boomers and 65% of Gen Xers, according to a Ramsey Solutions research study. And compared to older generations, Millennials like you have decades longer to save!

If you’re a Millennial, how can you harness that time to build wealth? It’s simple! Get started with these five steps:

Be Confident About Your Retirement.

Find an Investing Pro

Step 1: Know the Why Behind Your Wealth-Building

We get it. When you’re young, saving for your future doesn’t feel very urgent. That’s over thirty years away! You want to be responsible, but you also want to enjoy your life now.

So how do you stay motivated for the long-term? You need a strong why. Here’s a tip: Your why should be more specific than just saving for retirement or leaving a legacy. Take the time to dream about the details and share them with others, especially your investing pro . Maybe you want to:

- Travel the world without worrying about money

- Support causes and ministries financially

- Take your whole family on an all-expenses paid vacation when you retire

- Help your grandkids pay for college

- Retire in your 50s!

Most importantly, your why has to be yours. With every contribution, you’ll get fired up knowing that you’re that much closer to your dream. Now that’s saving with a purpose!

Step 2: Start Saving NOW

When you’re starting your career, being financially secure enough to quit your job may seem impossible. According to a recent Merrill Edge report, 83% of Millennials plan to work in their retirement. And nearly one in five of the survey participants claimed they would need to “win the lottery” to be able to retire. And these are Millennials like you, who still have decades left to save!

Having options when you get to retirement is possible. If you start your wealth-building plan now, it takes a lot less effort than you think.

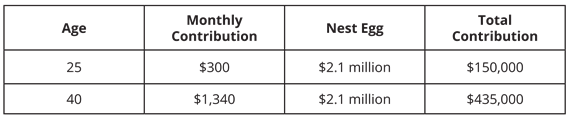

Let’s say you start investing a modest $300 a month when you’re 25 years old. By retirement, your nest egg could be worth $2.1 million! Your contributions only make up $150,000 of that grand total. The rest is compound growth!

What if you wait until you’re 40 to start saving for retirement? You would have to invest $1,340 a month to get to that same $2.1 million. Since compound growth doesn’t have as long to do its job, your contributions would make up almost $435,000 of that total.

Can you have a secure retirement if you don’t get started until your 40s? Absolutely! You just have to work harder to do it.

And the best part about starting early is that you have wiggle room in your budget to reach other goals. You could save for a new house or take that dream vacation. You could go out with your friends without feeling guilty! Can you imagine what that kind of freedom would feel like?

After starting that early, do you think could even retire sooner? You bet! What if you saved $500 a month? Or $750 a month? Use our investing calculator to see the long-term impact of your contributions. The earlier you start, the easier it is to get to that million-dollar milestone.

Step 3: Switch Your Savings Gears

If you’re a Millennial, it’s likely that you’re already great at saving. Fidelity research shows that 59% of Millennials have money saved in an emergency fund to cover unexpected costs. Even more impressive, their average savings sit at $9,100. That’s higher than the average emergency fund savings of both Gen Xers and Baby Boomers. Bravo, Millennials!

Since many of you are already flexing your saving muscle, setting money aside for your future just means switching gears. Once you have 3–6 months of expenses saved for emergencies, it’s time to move away from cash savings and into the stock market by investing in a 401(k) or Roth IRA .

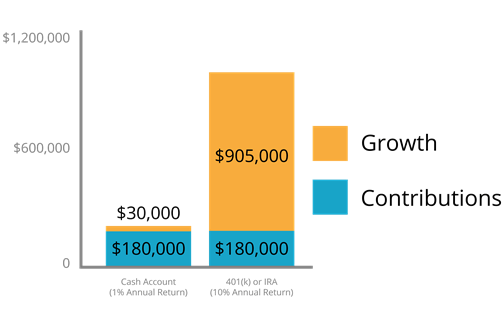

Saving cash may seem safer than the stock market, but the returns of the stock market are worth it. You’ll be lucky if you average a 1% rate of return in a cash account, but the S&P 500 has averaged over 11% growth over the past 30 years. When it comes to your wealth-building plan, cash won’t cut it.

Here’s how the average annual returns can impact your savings if you invest $500 per month over 30 years:

That’s a million-dollar difference! It’s okay to use cash accounts for short-term savings goals, but you need the power of mutual funds in your 401(k) and IRA accounts for long-term saving.

The great news is that many Millennials are already contributing to workplace retirement accounts. In fact, their median savings rate improved even more than Baby Boomers or Gen Xers over a two-year period, increasing from 5.8% to 7.5%, according to a Fidelity study.

While 7.5% is a great start, we recommend saving 15% of your income toward retirement. Simple changes like creating a plan for your money every month can help you get your savings on track!

Step 4: If You Change Jobs, Roll Your Retirement Over

As soon as you started your first job, you may have started contributing to a workplace retirement account. Millennials start saving for retirement at the average age of 23, according to a Ramsey Solutions research study. But here’s something else to consider: A recent LinkedIn study found that Millennials have an average of four different jobs by the time they’re 32.

Combining these two stats brings up an important question for Millennials. What happens to your retirement savings when you switch jobs? If you’re not careful, you could make a mistake that costs you hundreds of thousands of dollars.

According to Fidelity, the average cash-out amount for workers under 40 who switch jobs is $14,300. That may not sound like a lot, but here’s what happens when you cash it out instead of rolling it over to an IRA:

- You’ll have to pay a 10% penalty for early withdrawal.

- You’ll have to pay taxes based on your tax bracket.

- You miss out on any compound growth.

If you rolled that $14,300 into an IRA when you switched jobs at age 30, it could be worth over $485,000 by retirement. If you cash it out, you could be left with only $9,650, depending on your tax bracket. That cash-out could cost you close to half a million dollars!

Does that seem like a good deal? We don’t think so! Unless you want your job-hopping to keep you from wealth building, roll over any workplace retirement accounts with each job switch. Easy enough!

Step 5: Be Active in Your Wealth-Building Plan

Around 94% of Millennials said they want to learn more about investing, according to Schroders Global Investors Study. Chances are, that’s you. You’re already making some good decisions with your money, and you’re probably doing research on your own to find out the answers to your questions about building wealth.

But let’s set the record straight . Doing some research online then setting your investments on auto-pilot is not an investing strategy.

Your situation is unique, and your investing portfolio deserves a personalized approach. An investing professional can help you:

- Learn about investing so you feel empowered to make decisions

- Maximize your investment growth while taking your risk tolerance into account

- Evaluate your fund performance so you can keep your portfolio balanced

Don’t leave your retirement strategy up to chance. Get involved and stay involved for the long term by working with an investing pro.

Posted By : https://www.daveramsey.com/blog/million-dollar-plan-for-millennials

Contact Information

Business Hours

- Mon - Fri

- -

- Sat - Sun

- Closed

Quick Form

Contact Us

Thank you for contacting us.

We will get back to you as soon as possible.

Please try again later.

Contact Information

Business Hours

- Mon - Fri

- -

- Sat - Sun

- Closed

Contact Us

Contact Us

Thank you for contacting us.

We will get back to you as soon as possible.

Oops, there was an error sending your message.

Please try again later.

Browse Our Website

Contact Information

Business Hours

- Mon - Fri

- -

- Sat - Sun

- Closed